SUNNINGDALE TECH LTD

ANNUAL REPORT 2014

CORPORATE GOVERNANCE REPORT

22

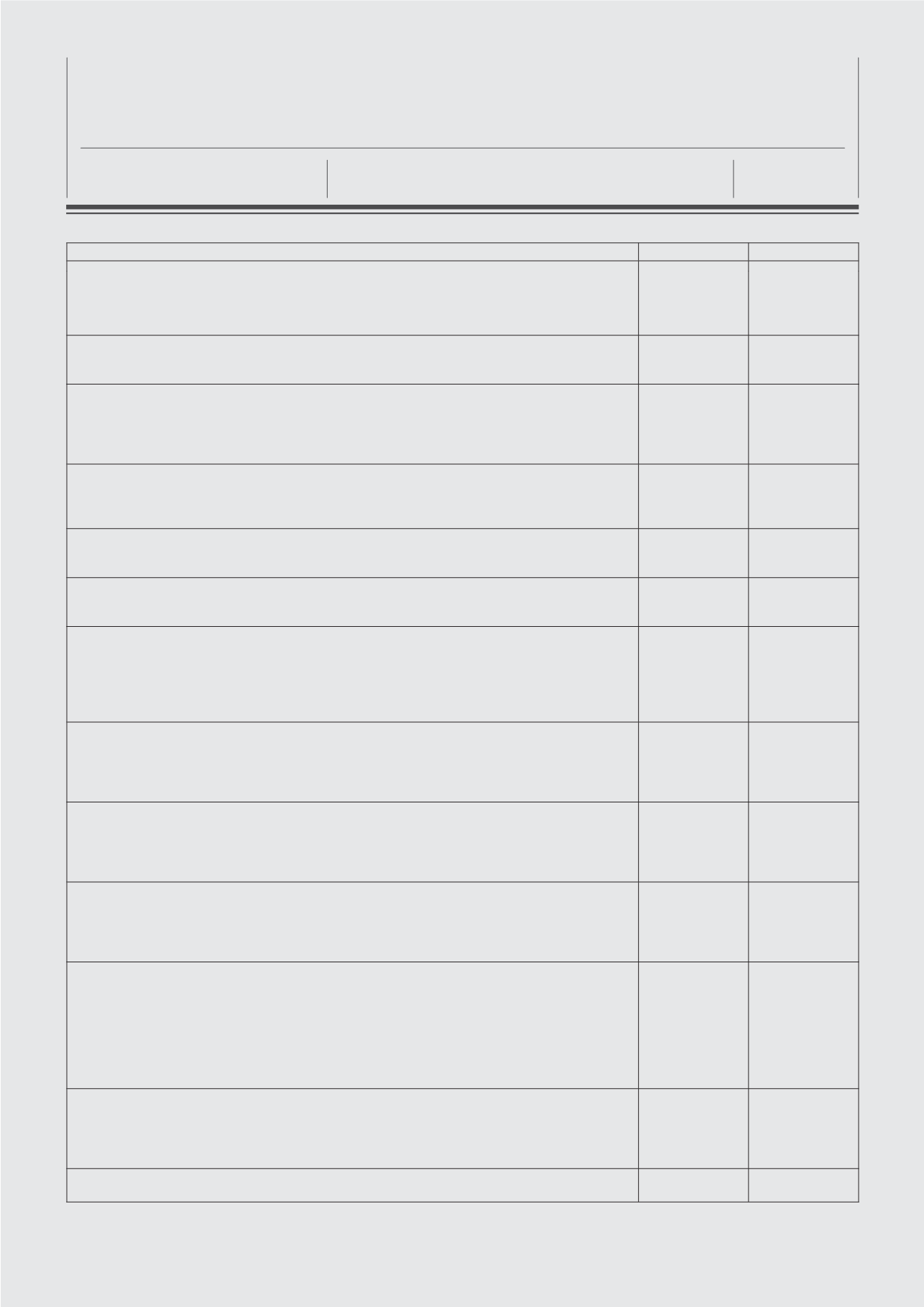

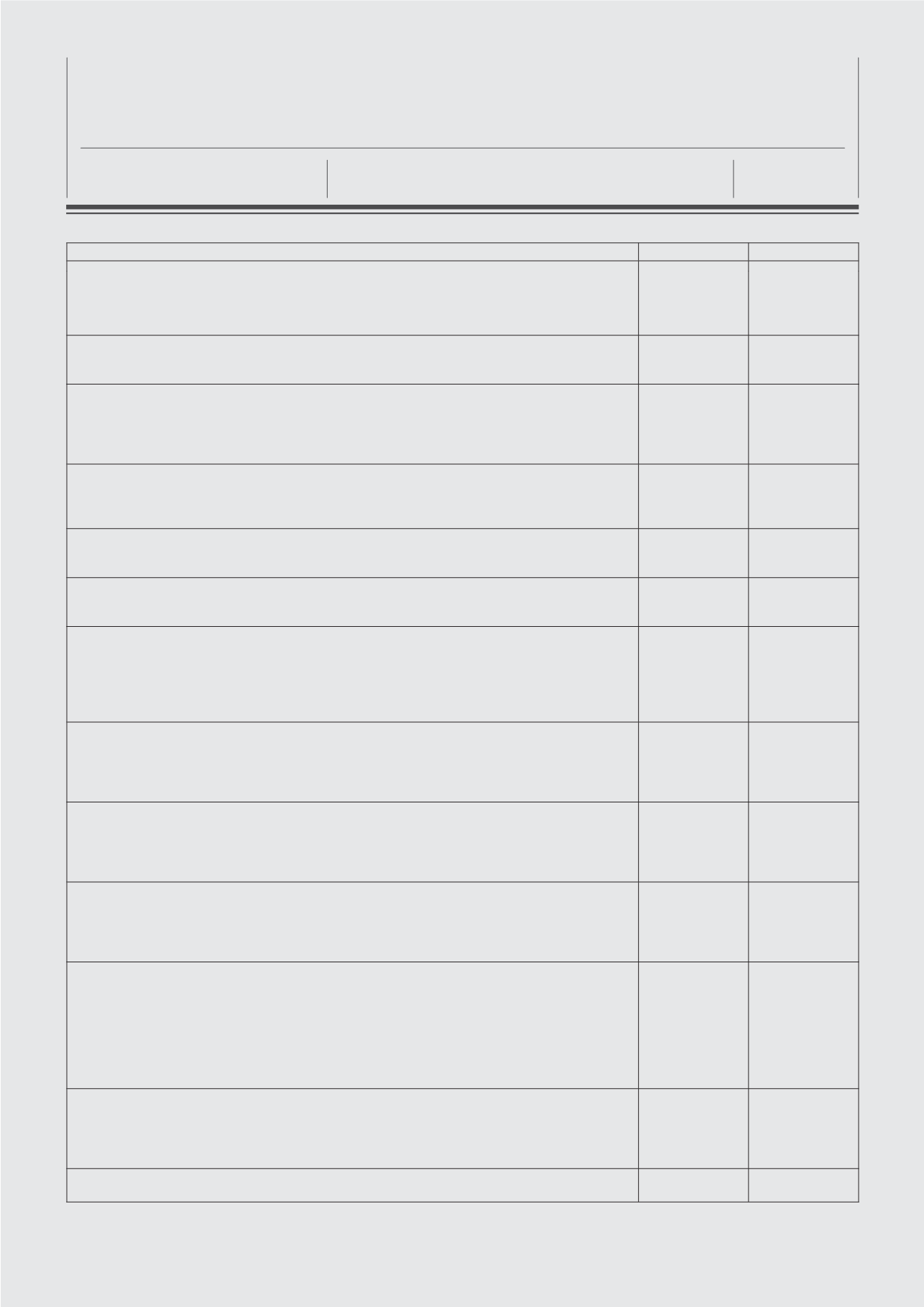

Code Principles & Guidelines with Specific Disclosure Requirements

Compliance Page Reference

Principle 5 : Board Performance

There should be a formal annual assessment of the effectiveness of the Board as

a whole and its Board Committees and the contribution by each director to the

effectiveness of the Board.

√

28

Guideline 5.1

Assessment of the contributions of the Board, Board Committees and individual Directors to

the effectiveness of the Board; and if such assessment is by an external facilitator.

√

Principle 6 : Access of information

In order to fulfil their responsibilities, Directors should be provided with complete,

adequate and timely information prior to Board meetings and on an on-going basis

so as to enable them to make informed decisions to discharge their duties and

responsibilities.

√

28

Principle 7 : Procedures for Developing Remuneration Policies

There should be a formal and transparent procedure for developing policy on executive

remuneration and for fixing the remuneration packages of individual Directors.

No Director should be involved in deciding his own remuneration.

√

29

Guideline 7.1

Names of the members of the Remuneration Committee (“RC”) and the key terms of reference

of the RC, explaining its role and the authority delegated to it by the Board.

√

Guideline 7.3

Names and firm of the remuneration consultants (if any), including a statement on whether the

remuneration consultants have any relationships with the Company.

√

Principle 8 : Level and Mix of Remuneration

The level and structure of remuneration should be aligned with the long-term interest

and risk policies of the company, and should be appropriate to attract, retain and

motivate (a) the Directors to provide good stewardship of the company, and (b) key

management personnel to successfully manage the company. However companies

should avoid paying more than is necessary for this purpose.

√

30

Principle 9 : Disclosure of Remuneration

Every company should provide clear disclosure of its remuneration policies, level and

mix of remuneration, in the Company’s Annual Report. It should provide disclosure in

relation to its remuneration policies to enable investors to understand the link between

remuneration paid to directors and key management personnel, and performance.

√

32

Guideline 9.1

• Remuneration of Directors, the CEO and at least the top 5 key management personnel of

the Company.

• The aggregate amount of any termination, retirement and post-employment benefits that

may be granted to Directors, the CEO and the top 5 key management personnel.

√

Guideline 9.2

Fully disclose the remuneration of each individual Director and the CEO on a named basis with a

breakdown (in percentage or dollar terms) of each Director’s and the CEO’s remuneration earned

through base/fixed salary, variable or performance-related income/bonuses, benefits-in-kind,

stock options granted, share-based incentives and awards, and other long-term incentives.

√

Guideline 9.3

• Name and disclose the remuneration of at least the top 5 key management personnel

in bands of S$250,000 with a breakdown (in percentage or dollar terms) of each key

management personnel’s remuneration earned through base/fixed salary, variable

or performance-related income/bonuses, benefit-in-kind, stock options granted,

share-based incentives and awards, and other long-term incentives.

• In addition, the Company should disclose in aggregate the total remuneration paid to the

top 5 key management personnel.

√

Guideline 9.4

Details of the remuneration of named employees who are immediate family members of a

Director or the CEO, and whose remuneration exceeds S$50,000 during the year with clear

indication of the employee’s relationship with the relevant Director or the CEO. Disclosure of

remuneration should be in incremental bands of S$50,000.

√

Guideline 9.5

Details and important terms of employee share schemes.

√

CORPORATE GOVERNANCE REPORT